Redesign for

Tax Guide Webpage

Industry: Goverment admimistration

Type of work: User Experience \ Usability Testing \ Product Strategy

Client: Guangndong Provincial Tax Bureau

My Role: User Research, Usability Testing, User Experience

Teammates: collaborated with a UI designer, and a researcher from our company

Date: May.2021-Jun.2021

Extent of the project: 1 months, full-time

About the project

The “Tax Guide” is a section on the official website of the Guangdong Provincial Tax Bureau for taxpayers to query tax processing procedures, required materials, and other related information. It serves as the first touchpoint for taxpayers to handle tax-related businesses and aims to resolve any inquiries they may have.

The user experience of the “Tax Guide” section on the official website of the Guangdong Provincial Tax Bureau, which is under the State Administration of Taxation, is inadequate in terms of entering the section, searching for specific matters, and viewing guide details. Therefore, there is a need for optimization in terms of architecture, functionality, and visual design.

Impact

The project design is being iterated through three distinct phases. Phase 1 has now concluded.

What I did

I participated in the entire process of this project, from the preliminary research on competitor products and in-depth user interviews to the later development of new workflow architecture and the delivery of low-fidelity prototypes.

Our goal is to assist taxpayers in obtaining the necessary tax information quickly and accurately, while also enhancing the overall user experience.

Project Purpose

- Convenient Pathfinding: Clear Architecture, Smooth Workflow, and Flexible Search

- User-friendly Features: In line with taxpayer usage habits, improving search efficiency.

- Rapid Access to Information: Easy-to-understand information and information segmentation.

- Clear Page Presentation: Clear Visual Hierarchy and Consistent Design.

Text results

The following summarizes the results and recommendations from usability testing of 19 participants. Our analysis covers insights from an overall perspective down to specific issues.

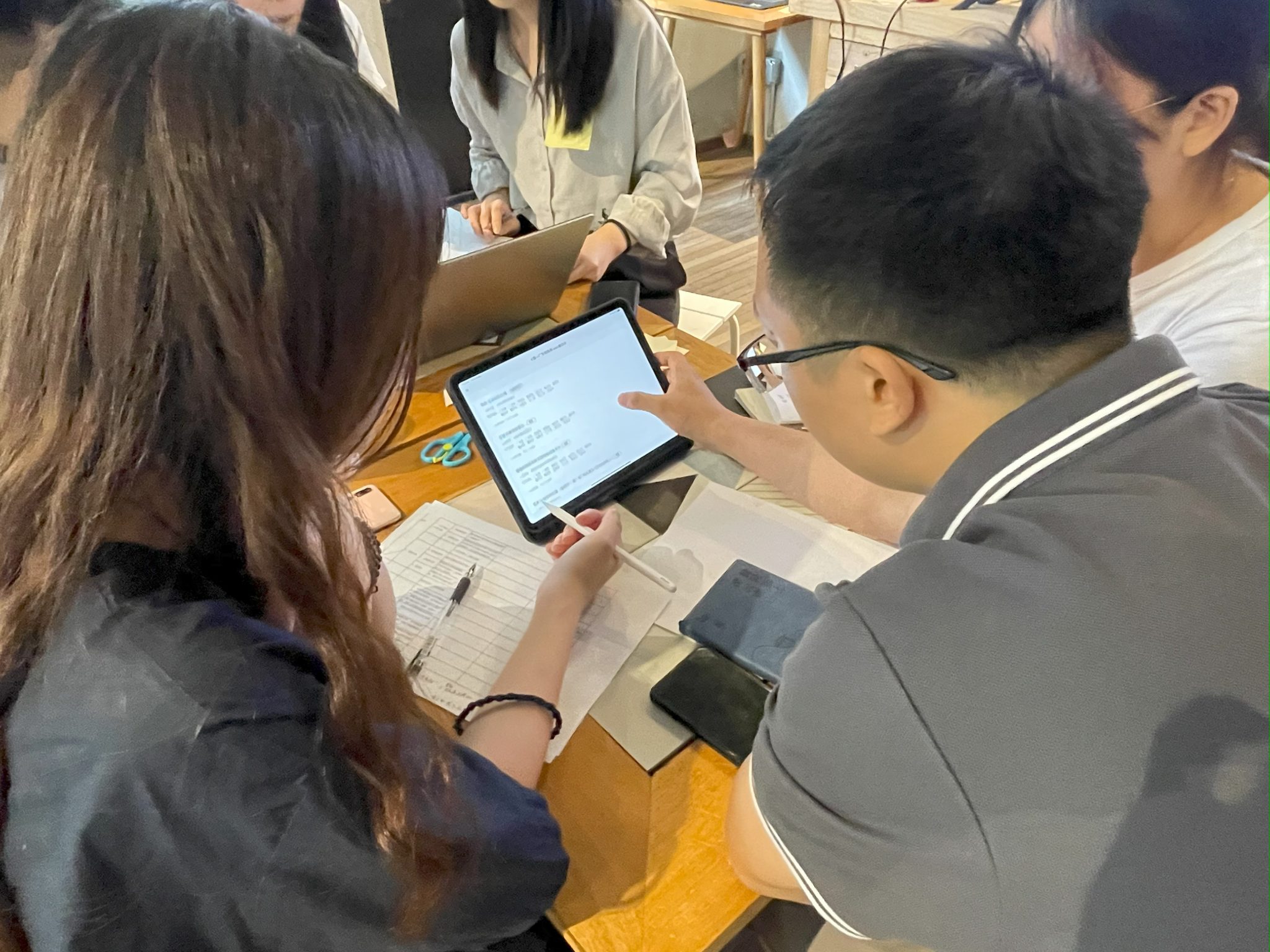

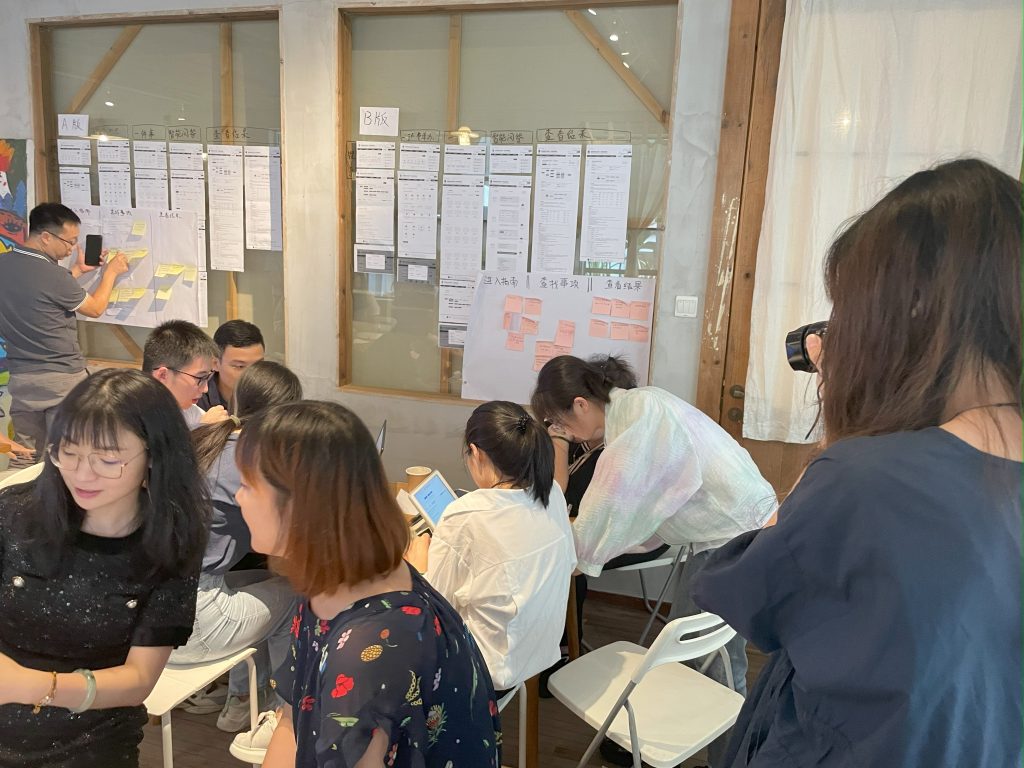

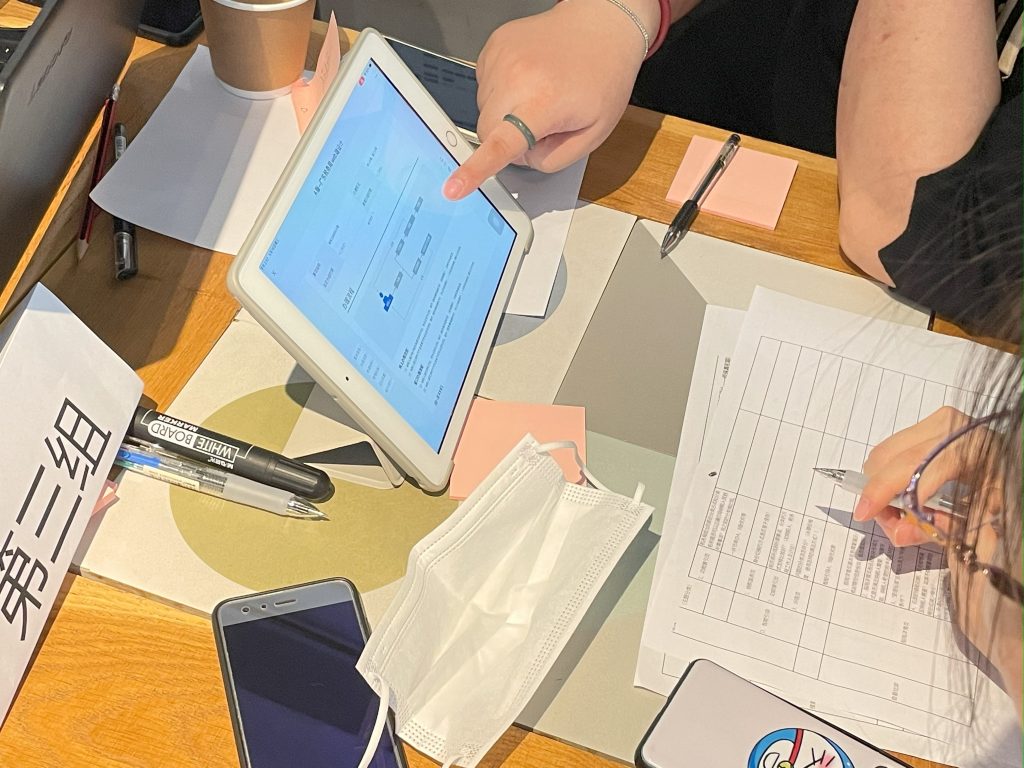

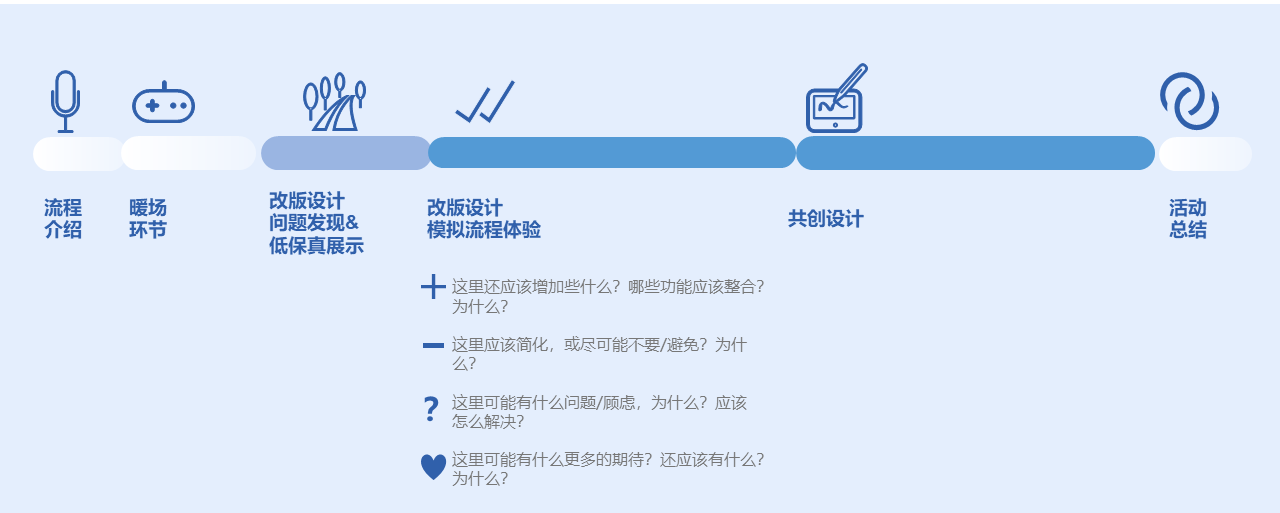

workshop

Based on the test results, we created a basic low-fidelity prototype. We then conducted a workshop with taxpayers, tax agency staff, and software developers to discuss the pros and cons and feasibility of the new design.

This collaborative workshop was highly useful for vetting and refining our initial design concept. The lessons learned from this session will guide further improvements to the prototype and shape the next round of user research.

Design

By synthesizing insights from our co-creation workshop and initial research, we refined the website architecture and functionality. When combined with findings from stakeholder interviews and surveys, we formulated targeted enhancements to navigation, content structure, and interface interactions.

Lifecycle

-

Define Design Concept/Ideas2 weeks

-

Complete Prototype Design8 weeks , 19 users

-

Conduct Usability Testing1 weeks

-

Perform Development12 weeks

Methodology

- Desktop Research: Collecting, sorting, and integrating relevant information through secondary data sources. Desktop research includes two main components: theoretical literature research and analysis of existing regulatory documents.

- Benchmarking Study: Selecting representative service guides from government services, public services, commercial services, and other fields for benchmarking studies, to identify optimization and innovation points that can be applied to the design of the current section.

- In-depth Interview: Using questioning and discussion techniques to understand the tax-related work experience of taxpayers of different types, as well as their habits and requirements for collecting information and handling tax-related matters.

- Usability Testing/User Feedback Testing: Building certain usage scenarios for users, requiring individual users to complete a set of tasks, and observers can interact with users at any time to ask questions or further explore. Understand the current usage status and pain points through the operation and use of real users.

- Creative Workshop: The creative workshop aims to invite taxpayer service experience specialists, tax personnel, zero-point researchers, service designers, and technical developers to participate together, generating innovative design concepts through multi-role collisions and communication.